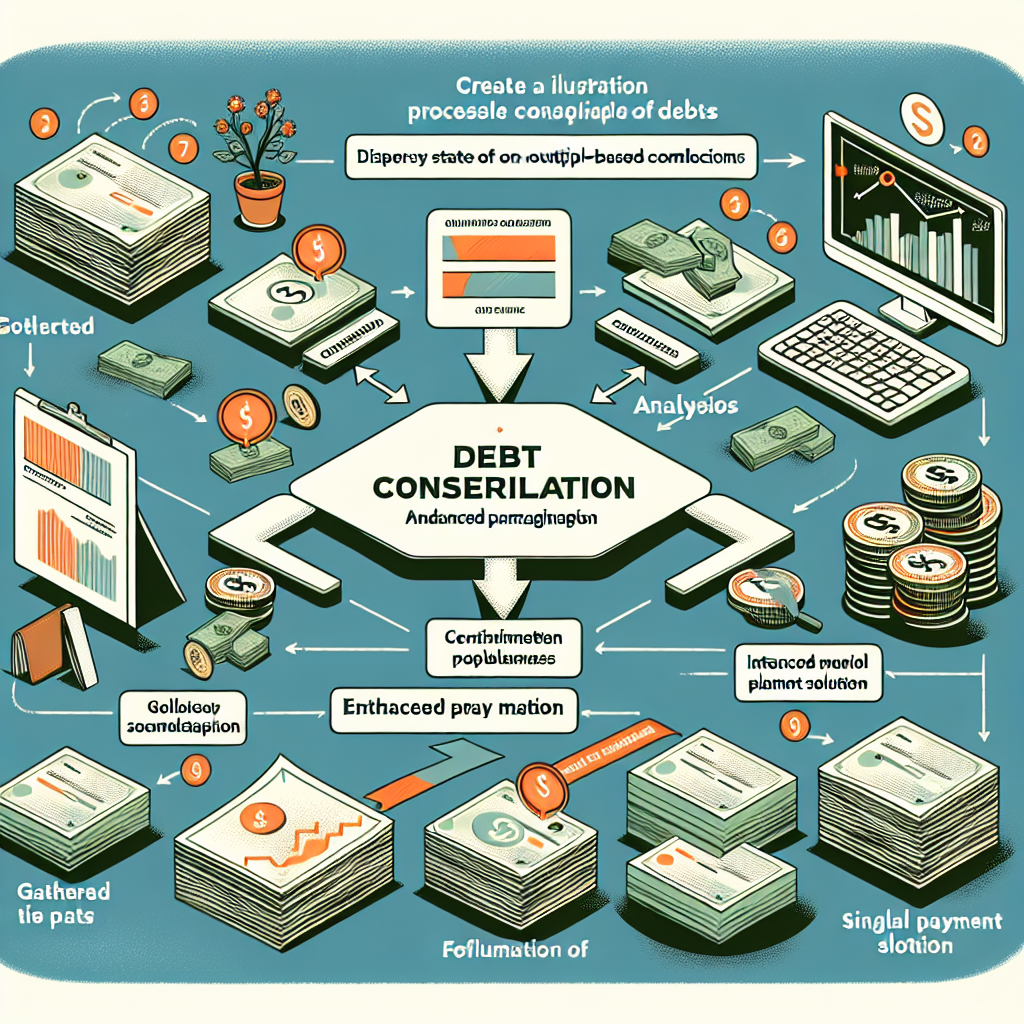

Juggling multiple debts can quickly become overwhelming, leading to financial stress and a higher risk of missed payments. With varying interest rates, repayment schedules, and lenders to manage, it’s no wonder many seek a more streamlined approach. Debt consolidation offers a strategic solution, bringing several obligations together into a single, more manageable payment.

This method leverages tools like balance transfers, personal loans, and home equity loans to simplify repayment. The potential benefits—lower interest rates, reduced monthly payments, and better financial organization—can be significant. However, the success of debt consolidation depends on factors such as your credit profile, repayment discipline, and the specifics of the new loan or credit arrangement.

It’s important to remember that while debt consolidation can be advantageous, it isn’t a universal remedy. Careful evaluation of available methods and a thorough understanding of their implications are essential before proceeding. The following sections break down the primary methods, key benefits, and crucial considerations to help you make informed choices about debt consolidation.

Debt Consolidation Methods: Exploring Your Options

When faced with mounting financial obligations, knowing your options is the first step toward regaining control. Each debt consolidation method has its own strengths and limitations, so identifying the approach that best suits your circumstances can make all the difference.

Balance transfer credit cards provide immediate relief for those with high-interest credit card debt. By moving balances to a single card—often featuring an introductory 0% APR period—you can focus on repaying the principal without accumulating extra interest for a limited time. Keep in mind, though, that this option typically requires a strong credit score and may include transfer fees. According to Experian, average balance transfer fees range from 3% to 5% of the transferred amount, which can affect your total savings.

Personal loans offer a structured, predictable path for those seeking to consolidate various debts—like credit cards, medical bills, or payday loans—into a single monthly payment at a fixed interest rate. The stability of fixed terms can provide peace of mind, but the interest rate you receive will depend on your creditworthiness. In some cases, if the repayment period is extended, the total interest paid may actually increase, even if monthly payments decrease.

For homeowners, tapping into property equity through a home equity loan or home equity line of credit (HELOC) can result in lower interest rates since the loan is secured by your home. However, there’s a significant tradeoff: failure to repay could put your home at risk. As Suze Orman warns, “Using your home as collateral is a double-edged sword; it can save you money, but it also raises the stakes.”

Another path is enrolling in a debt management plan (DMP) through a nonprofit credit counseling agency. A DMP allows the agency to negotiate with creditors on your behalf—potentially lowering interest rates or waiving fees—and consolidates your payments into one monthly sum. While this doesn’t eliminate your debt, it can simplify the process and help avoid further penalties. Note that enrolling in a DMP may impact your ability to obtain new credit during the program, and not all creditors may participate.

Ultimately, the most effective method is the one tailored to your unique needs—taking into account your credit history, assets, and long-term goals. Carefully comparing your options and understanding the commitments involved lays the foundation for improved financial stability.

Key Benefits of Debt Consolidation

Consolidating debt can turn a complicated financial situation into a clear, achievable plan, often serving as a key turning point for those seeking financial control. The impact goes well beyond convenience, offering deeper benefits that can improve your overall financial health.

One of the most notable advantages is the potential for lower overall interest costs. By replacing high-interest debts (like credit cards or payday loans) with a product that offers a reduced rate, substantial savings are possible over the life of the loan. For example, the Federal Reserve reported that average credit card interest rates exceeded 20% in 2023, while qualified borrowers secured personal loans at rates often below 10%. This difference can result in significant long-term savings.

Combining multiple debts into one payment not only eases monthly budgeting, it may also have a positive effect on your credit score. Responsible management can lower your credit utilization ratio—a crucial component in most credit scoring models. Consistently making timely payments on the new loan or credit line further enhances your credit profile, often unlocking better financial opportunities down the road.

Moreover, consolidation can lead to a reduction in financial stress. The American Psychological Association found that money remains the leading source of stress for 72% of Americans. Streamlining your bills often brings a sense of relief and renewed confidence. As Dave Ramsey points out, “When you only have one payment to track instead of five, it’s easier to stay focused and make progress.”

- Lower interest rates can mean faster debt repayment.

- Single monthly payment streamlines your finances, making it easier to avoid missed deadlines.

- Improved credit profile is possible with responsible management and reduced utilization.

- Less stress and better organization often lead to greater peace of mind.

While these advantages can be substantial, their realization depends on selecting the right consolidation method and adhering to disciplined repayment. When used wisely, debt consolidation can be a powerful step toward lasting financial well-being.

Important Considerations Before Consolidating Debt

Before committing to debt consolidation, it’s important to understand why some individuals achieve lasting relief while others find themselves back in financial difficulty. The appeal of a single, manageable payment is strong, but success depends on careful attention to both short-term terms and long-term consequences.

Start by assessing the total cost of repayment. Lower monthly payments may seem attractive, but if your loan term is extended, you could end up paying more in interest over time—even with a lower rate. Be sure to calculate the aggregate interest and fees before agreeing to any new arrangement. The Consumer Financial Protection Bureau notes that longer terms can increase total costs despite initial savings.

Your credit standing is another key factor. Those with strong credit scores are more likely to qualify for favorable rates, while borrowers with fair or poor credit may face higher costs or limited choices. Reviewing your credit report for errors and taking steps to improve your score can pay off. As Liz Weston advises, “Even a small improvement in your credit score can translate into significant savings on a consolidation loan.”

Be alert for upfront fees or penalties. Some products include origination fees, balance transfer fees, or prepayment penalties that can reduce potential benefits. Request a complete breakdown of all charges and compare multiple offers before making a decision.

- Secured loans (such as home equity loans) put assets at risk—losing collateral can have lasting repercussions.

- Variable interest rates may introduce unpredictability to your repayment plan.

- Loss of borrower protections may occur if federal student loans are consolidated with private lenders.

Lastly, reflect on your personal habits and the root causes of debt. While consolidation can streamline payments, it doesn’t address issues like overspending or inconsistent income. Without a realistic budget and a commitment to change, there’s a risk of accumulating new debt alongside the consolidated loan. Jean Chatzky emphasizes, “Consolidation is a tool, not a cure. Lasting progress comes from changing the habits that led to debt in the first place.”

A successful consolidation strategy weighs immediate benefits against overall costs, risks, and personal financial behaviors. By approaching the process thoughtfully, you can transform debt consolidation from a temporary solution into a meaningful step toward financial stability.

Empowering Financial Progress Through Informed Debt Consolidation

Embracing debt consolidation can be a proactive move for those seeking to regain financial control. By carefully evaluating your options and aligning them with your unique goals and circumstances, you can maximize rewards while minimizing risk.

The true value of consolidation lies in a balanced approach—acknowledging both its transformative advantages and the critical considerations that shape long-term results. Success requires not just the right tools, but also a commitment to responsible borrowing, disciplined repayment, and lasting behavioral change.

Informed decisions about debt consolidation can turn financial complexity into clarity. With knowledge as your foundation, you’re empowered to move beyond short-term relief and build a future marked by resilience and confidence.