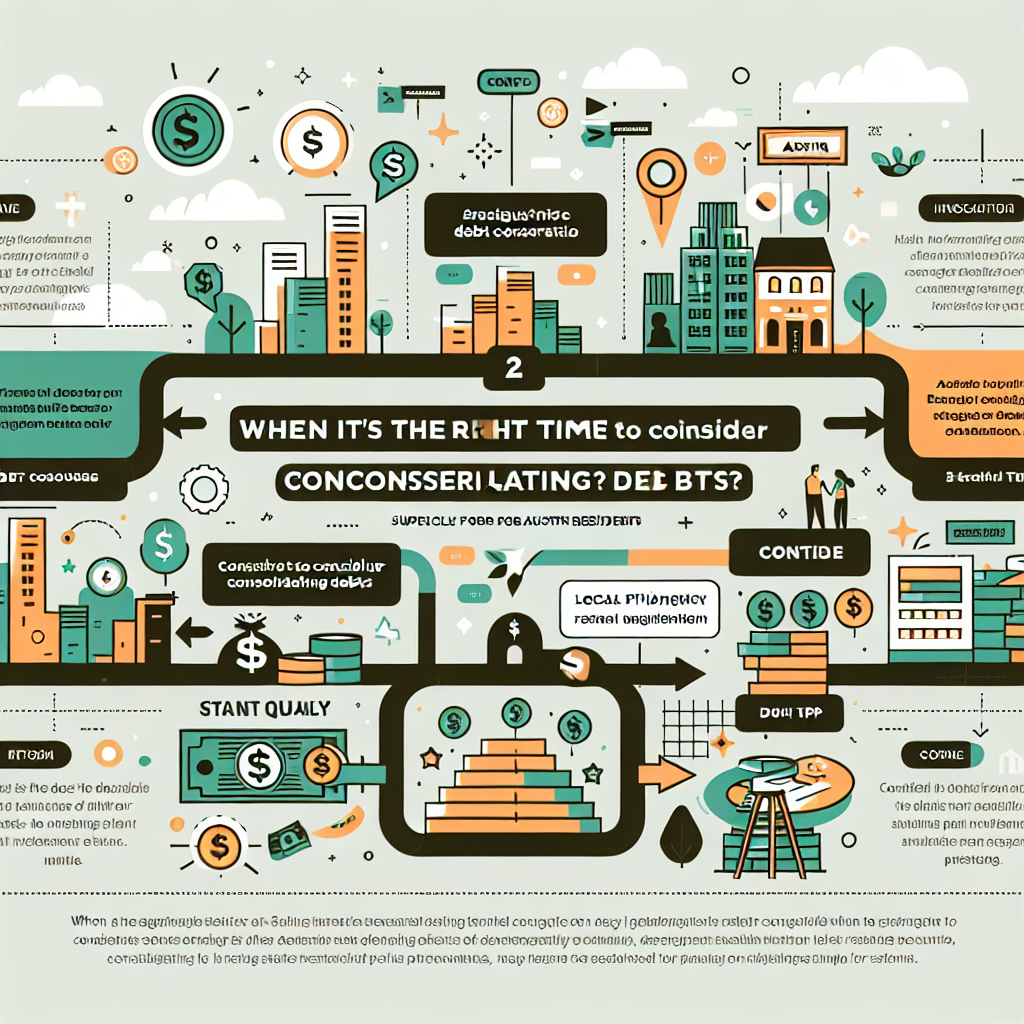

Managing multiple debts can be a daunting challenge, especially for residents of thriving cities like Austin, TX, where the cost of living continues to rise and financial obligations often pile up. If you find yourself juggling various credit card balances, personal loans, or medical bills, understanding your options is crucial. Debt consolidation is a strategic financial solution that allows individuals to combine several debts into a single, more manageable payment, often with a lower interest rate and simplified terms.

Recognizing when to consolidate debt in Austin, TX is essential to optimizing your financial health. Factors such as fluctuating income, rising interest rates, and the unique economic landscape of the Austin area all play a role in determining the right time and approach. By consolidating your debts, you may be able to reduce financial stress, improve your credit score, and regain control over your budget. This comprehensive guide will help you explore the benefits and drawbacks of debt consolidation, offering practical tips tailored for Austin residents and linking you to trusted local resources to support your journey toward financial stability.

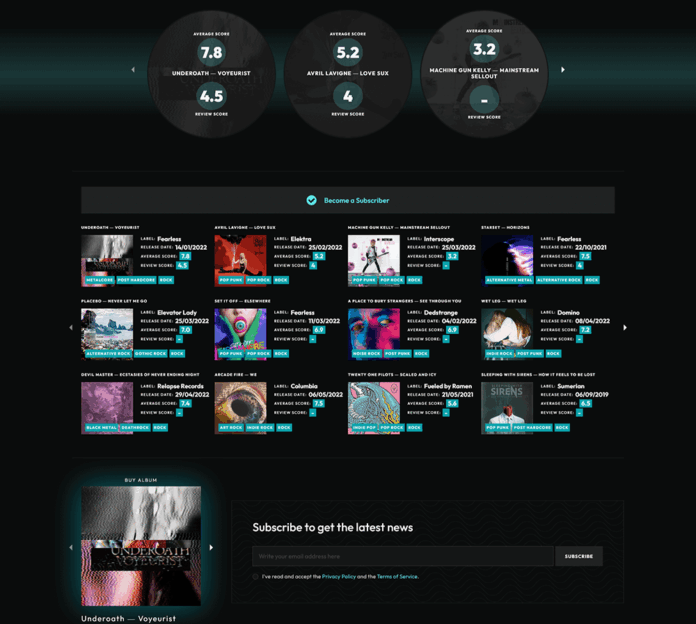

Understanding When to Consolidate Debt in Austin, TX

Have you ever wondered if there’s a perfect moment to take charge of your mounting bills? While the answer isn’t always straightforward, certain financial signals act as clear indicators. In a city celebrated for its vibrant culture and steady economic growth, timing your consolidation strategy can make all the difference between lasting relief and temporary fixes.

Timing plays a pivotal role in debt consolidation success. Economic fluctuations unique to Austin—such as rapid job market changes and rising housing costs—can impact your ability to keep up with multiple obligations. Recognizing these local realities, it’s critical to assess not only your personal financial health but also the broader economic environment before making a move. If you’re experiencing difficulty keeping track of due dates or notice that minimum payments barely dent your balances, you may be at a crossroads where action becomes necessary.

Three actionable tips to determine if it’s time to consolidate:

- Monitor your monthly cash flow: If over 40% of your income goes toward debt payments, consolidation could help free up your budget. Take a look at these local strategies to see if one suits your needs.

- Evaluate interest rates: When you notice your average interest rate creeping above 15%—especially on credit cards—exploring a consolidation loan with a lower rate can save you significant money over time.

- Check your credit report regularly: Spotting missed payments or a declining score? Addressing these early with consolidation can help prevent further damage. For more insight, review how Austin residents can rebuild credit after consolidating.

Although consolidation offers potential relief, it’s not a one-size-fits-all remedy. For example, if most of your obligations stem from federal student loans or newly accrued medical bills, other targeted solutions might be more effective. Conversely, those juggling several high-interest credit cards or personal loans may benefit from a single, streamlined payment structure. Consider your unique financial profile, local Austin resources, and the types of debts involved to determine the best timing and method.

For a deeper dive into the pros and cons, or to explore specific local programs, visit MoneyAidNews.com’s Texas Debt Relief Guide. Explore options here.

Key Reasons Austin Residents Should Consider Debt Consolidation

Ever found yourself making payments each month, only to feel like you’re treading water financially? For many in Austin, the answer isn’t about working harder, but about working smarter with your finances. Debt consolidation emerges as a strategic tool, especially when local economic pressures and personal obligations collide. Let’s explore why this approach may be particularly beneficial for those living in the heart of Texas.

In a city where living costs and personal debt loads are on the rise, effective financial management is crucial. Debt consolidation offers several tangible advantages that can help Austin residents regain financial footing, protect their credit, and prepare for future economic shifts.

- Simplified Finances: Managing multiple bills from various creditors can quickly become overwhelming. By consolidating, you’re able to replace several payments with one fixed monthly obligation, making it easier to budget and avoid missed due dates. This is particularly helpful if you’re dealing with a mix of credit cards, medical bills, or personal loans—a common scenario for Austinites balancing work, family, and the city’s dynamic lifestyle.

- Potential for Lower Interest Rates: Austin’s competitive lending market gives residents the chance to qualify for consolidation loans at interest rates lower than those on many credit cards. According to recent data, the average credit card interest rate in Texas can exceed 18%. By securing a lower rate, you could save hundreds—or even thousands—over the life of your loan. This financial breathing room is especially valuable in an environment where costs, from rent to groceries, continue to climb.

- Improved Credit Outlook: Timely payments on a consolidation loan may have a positive impact on your credit profile. Consistency counts—a single, manageable monthly payment reduces your risk of missed or late payments. Over time, this can help rebuild your credit score, especially if you avoid racking up new debt. For tips on credit improvement post-consolidation, check out MoneyAidNews.com’s guide for Austin residents.

- Reduced Financial Stress: The emotional toll of juggling debts can’t be overstated. By streamlining your payments, you’ll often experience greater peace of mind—and that’s more than just a number on a spreadsheet. In the fast-paced Austin environment, less stress translates to greater focus on your career, family, and personal growth.

Not sure which consolidation method fits your circumstances? Austin offers a range of local and state resources to help you navigate the options, from nonprofit credit counseling to local lenders. For a deeper look at available solutions, visit this curated list of Austin-specific debt consolidation resources.

Ultimately, debt consolidation isn’t just about lowering payments—it’s a proactive step toward long-term financial health. By leveraging the right tools and local expertise, Austin residents can transform their approach to debt, paving the way for a more stable and prosperous future. Explore options here.

Tips for Successful Debt Consolidation in Austin, TX

Have you ever wondered why some Austinites emerge from debt stronger than before, while others feel stuck despite their best efforts? The answer often lies in following a few practical, research-backed strategies that go beyond simply combining bills. As you chart your financial path, knowing how to avoid common pitfalls and maximize local advantages can make a substantial difference.

Below you’ll find a collection of actionable steps—tailored for Austin’s unique economic environment—that empower you to manage consolidation with confidence. Whether you’re weighing consolidation loans, balance transfer cards, or nonprofit counseling, these tips can help you achieve lasting financial relief.

- Compare Local Lenders and Programs: Not all consolidation solutions are created equal. Austin boasts a variety of community banks, credit unions, and regional lenders offering competitive rates and personalized terms. Start by gathering offers from at least three sources, including a mix of traditional institutions and digital platforms. Consider reaching out to local nonprofits for unbiased advice; they often have insight into Austin-specific programs that national providers overlook. Customization is key: A solution designed for someone in Dallas may not suit Austin’s cost of living or job market nuances.

- Set a Realistic Repayment Timeline: It’s tempting to choose the lowest possible monthly payment, but stretching out your loan could lead to paying more in interest over time. Instead, prioritize a consolidation plan with a clear payoff date—ideally within three to five years. Map out your cash flow, factoring in Austin’s fluctuating expenses like rising rent or seasonal utility costs, to avoid surprises. For guidance on creating a sustainable budget, check the resources at MoneyAidNews.com’s Texas Debt Relief Guide.

- Avoid Accumulating New Debt: After consolidating, it’s crucial to address the habits or emergencies that led to your original debt. Resist the urge to use newly freed-up credit lines for discretionary spending. Some Austinites find success by temporarily freezing or closing old accounts, while others set up automatic transfers to savings as a buffer against future setbacks. Consider following a proven plan for improving credit health—good habits now will pay dividends long after your consolidation loan is paid off.

While the road to financial stability may seem complex, these steps can serve as a reliable compass. By leveraging local expertise and remaining disciplined, residents of the Texas capital can transform consolidation from a short-term fix into a sustainable strategy for long-term security. Explore options here.

Empowering Austin Residents to Make Informed Debt Consolidation Decisions

For those navigating the fast-evolving financial landscape of Austin, TX, understanding when to consolidate debt is an essential step toward regaining control and fostering long-term security. By closely evaluating your unique circumstances—such as income fluctuations, interest rate trends, and local economic pressures—you can identify the optimal timing for consolidation and avoid common missteps.

Debt consolidation stands out as a powerful strategy to simplify payments, lower interest burdens, and reduce stress—provided it’s tailored to your personal needs and the realities of life in Austin. Leveraging local resources, seeking guidance from community-focused lenders, and adopting disciplined repayment habits can help transform consolidation from a temporary fix into a lasting financial foundation.

Ultimately, the decision to consolidate is not just about merging bills; it’s about choosing a proactive approach to your future. By making well-informed choices and tapping into Austin’s wealth of financial expertise, you set the stage for greater stability and peace of mind—allowing you to focus on what truly matters in the heart of Texas.